Shariah Complaint Zakat Management System of Moawin Foundation

Moawin Foundation formally adopted Shariah Compliant Zakat management system in the light of directives issued by Securities and Exchange Commission of Pakistan (SECP) in October 2023. Pursuant to the these directives MF appointed Mufti Zubair Ahmed, an SECP registered Shariah Advisor on January 1, 2024.

In order to ensure compliance with requirements of Shariah for utilization of Zakat, comprehensive Standard Operating Procedures (SOPs) were developed and approved by the BoD. After complying the Shariah covenants, Moawin Foundation was declared Shariah compliant organization through Shariah Certificate issued on February 1, 2024. This certificate is renewed every year. Current certificate is annexed.

Model adopted by Moawin Foundation

The mandatory requirement of Shariah for payment of Zakat is called Tamleek, which means transferring the Zakat into ownership of Zakat deserving person. There are following two types of Tamleek, both of which are permissible according to Shariah:

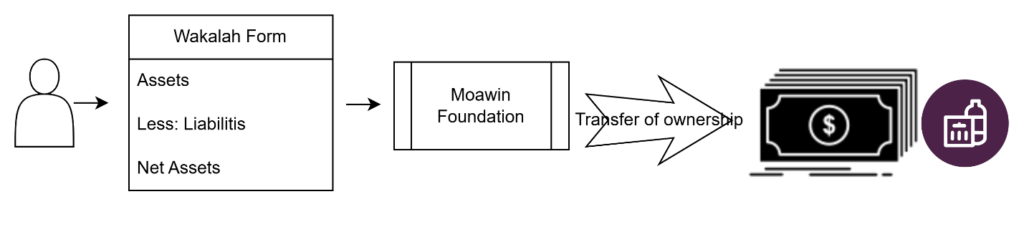

1- Physical Tamleek

To give Zakat amount/asset in the hand of deserving person transferring it to his bank account.

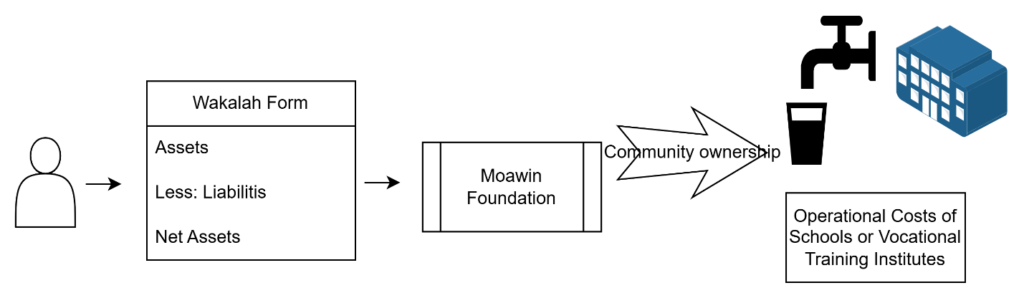

2- Tamleek through agent (Wakalah Modle)

Appointment of an agent for receiving of Zakat by the deserving person. Zakat can then be received by the agent on behalf of the deserving person. In this case school, Vocational Training Institutes related community ownership interventions can be carried-out.

In Tamleek through agent, when agent receives the amount or asset of Zakat on behalf of Zakat deserving person, Zakat is considered paid by the donor.

Process of Identification of Zakat Beneficiary

A comprehensive Wakalah Form has been developed for identification of Zakat Beneficiary, in this form permission is obtained from eligible person to appoint Moawin Foundation an agent on their behalf to:

- Collect Zakat on their behalf.

- To utilize Zakat money for their/other deserving persons needs and necessities.

A comprehensive list of Zakat Admissible uses is being followed by Moawin Foundation that covers vast needs of the beneficiaries especially with reference to our core interventions, such as education, skill development and welfare activities.

Moawin Foundation Activities

| Category | Amount |

|---|---|

| Zakat collected | Rs. 17.6 million |

| Zakat utilized | Rs. 12.2 million |

| Persons benefited from Zakat | 2,500 persons |

Some of the key Masaarif (admissible expense) of Zakat since adoption of Zakat Management System are as follows:

- Warm clothes and school uniforms for children – 1,357 students

- Ramadan Ration and Relief Ration pack for flood and fire affected – 337 packs

- Stationary items for student – 443 students

- Infrastructure & water related interventions – 200 beneficiaries

- Medical assistance has also been provided to some deserving individuals.

- Financial assistance for payment of fees for some students.

Oversight mechanism – Ensuring Financial Transparency

Following two tier oversight mechanism has been adopted by Moawin Foundation that ensures transparency in all the financial transactions executed under this mechanism:

A- Tier 1– Approval of Shariah Advisor to ensure compliance of SOPs:

The approval is mandatory for the following purposes:

- Identification of beneficiary – Each beneficiary is vetted by the Shariah Advisor.

- Approval of Masaarif – Each Masraf is approved by the Shariah Advisor.

B- Tier 2 – External Audit

Moawin Foundation has appointed M/s Grant Thornton, Chartered Accountants, ranked among the best audit firms. In the light of the directives issued by the SECP the external auditors are also entrusted with responsibility to audit transactions pertaining to Zakat. For the Financial Year 2023-24 external auditors reviewed compliance with SOPs and directives of SECP and expressed unqualified opinion and shared (note 4.12 of Audited Financial Statements):

“the Zakat is being spend according to Zakat Standard Operating Procedures and Policies developed by the Shariah Compliant Advisor”